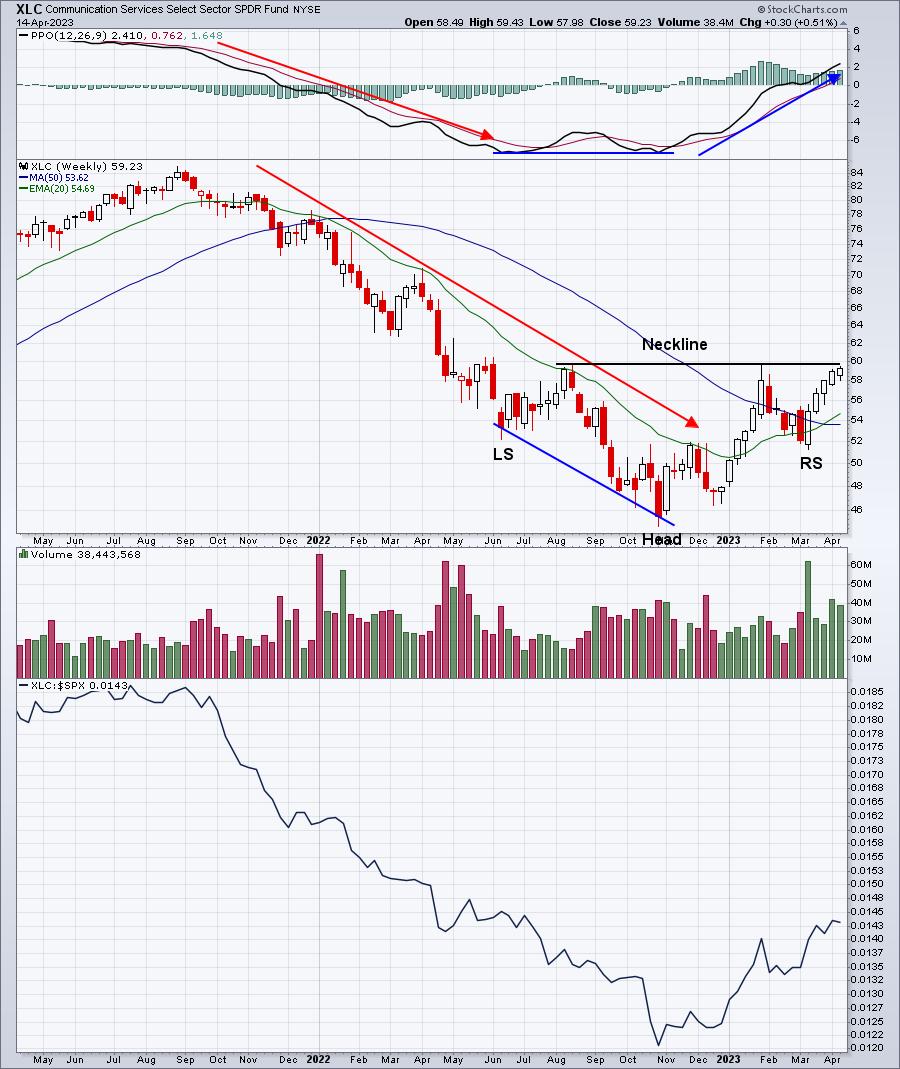

There are plenty of reversing patterns in technical analysis, but my personal favorite is the combination of a weekly positive divergence and a bottoming head & shoulders pattern. The positive divergence captures the slowing downside momentum and the head & shoulders provides confirmation that prices are indeed turning up. Keep in mind that a downtrend is nothing more than a series of lower highs and lower lows. When a potential neckline forms in a bottoming head & shoulders, it suggests that a prior “lower high” is being tested. The executed breakout then confirms that a new uptrend is underway.

During 2022, the worst-performing sector was communication services (XLC), the home of internet stocks ($DJUSNS), among others. Higher interest rates reduced the value of future earnings and earnings growth, but we’re now seeing interest rates come down. As a result, the XLC is on the verge of a beautiful reversing pattern and potential breakout. Check this out:

The bottom panel shows the XLC leading the stock market higher in 2023. I expect this to continue and the above breakout would certainly add to that likelihood.

I’m following one communication services stock, in particular, that could explode higher if I’m correct about the XLC gaining ground throughout 2023. I’ll be writing about it in our free EB Digest newsletter on Monday morning. If you’re not already subscribed, simply CLICK HERE to provide your name and email address and we’ll get you set up and send along this stock. There is no credit card information required and you may unsubscribe at any time.

Happy trading!

Tom