SPX Monitoring Purposes: Long SPX on 2/6/23 at 4110.98.

Monitoring Purposes GOLD: Long GDX on 10/9/20 at 40.78.

Long Term SPX Monitor Purposes: Neutral.

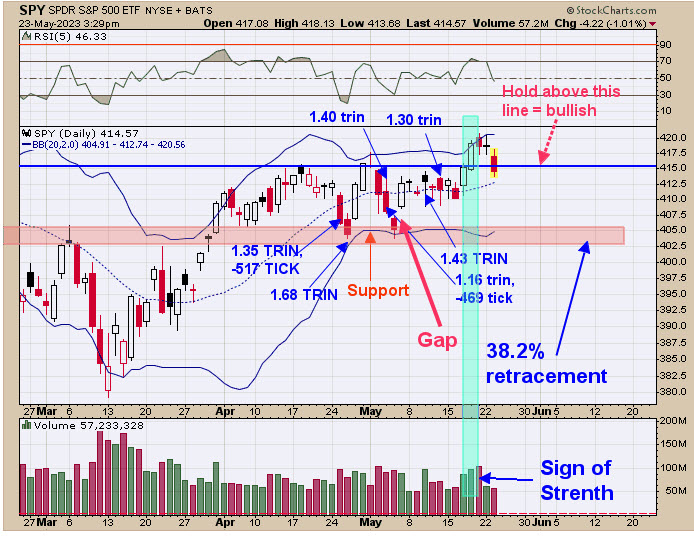

Yesterday, we said, “We posted the TRIN and TICK closing readings on the chart that reached panic levels. Most of the panic readings were reached in the 405 to 410 SPY range, which, in turn, suggests support. The more panic in a region, the more fuel the market has for the next rally. Panic is present when the TRIN closes above 1.20 and the TICK closes below -200. We put the Fibonacci levels on the chart up from the March low. So far, the largest retracement has been near the 38.2%, which suggests the current sideways move is at the halfway point of the move up. If you do the math, that gives a target near 445 SPY range, which about 6% higher.”

Added to the above, we had support previously near the 417.50 range, which was the May high. There are more price highs near the 415 range, which is turn suggests stronger support. We noted the “Sign of Strength” through the 415 SPY level, which suggests a confirmed breakout of that level. Today, the SPY tested that level on lighter volume, which suggests support. The uptrend appears intact.

We updated this chart from last Thursday, when we said, “the middle window is the 2-period moving average of the VVIX/VIX ratio. This ratio is also for good for finding negative divergence near highs in the SPX. A negative divergence is present when the VVIX/VIX ratio makes a lower high while SPX makes a higher high. We pointed out the previous divergences on chart above with red arrows. What we like to point out is that SPX has moved sideways since February while the VVIX/VIX ratio has made higher highs, and we regard this as a positive divergence. It appears that the VVIX/VIX ratio leads the way for the SPX, suggesting higher highs will be seen in the SPX.”

Added to the above, the market is heading into Memorial Day weekend, with markets closed this coming Monday. Most likely, volume will drop as Friday approaches and validity becomes less. Not seeing signs of a worthwhile high here.

Tim Ord,

Editor

www.ord-oracle.com. Book release “The Secret Science of Price and Volume” by Timothy Ord, buy at www.Amazon.com.

Signals are provided as general information only and are not investment recommendations. You are responsible for your own investment decisions. Past performance does not guarantee future performance. Opinions are based on historical research and data believed reliable; there is no guarantee results will be profitable. Not responsible for errors or omissions. I may invest in the vehicles mentioned above.