Anastasia P. Boden and Nathaniel Lawson

Arizona thinks that some people ought to be able to take other peoples’ property when they can put it to “better use.” We think not.

Under the Arizona Condominium Act, a supermajority of condo owners can force a minority of owners to sell their units against their will. That’s exactly what happened when an LLC called PFP Dorsey Investments bought ninety out of ninety‐six units in a condo building in Tempe and then forced the sale of the remaining six units to itself—never mind that the remaining owners, including Jie Cao, did not want to sell or to leave their homes.

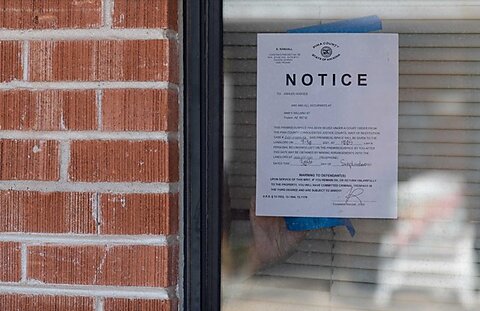

After the condo association changed the locks and shut the owners out, Cao brought a lawsuit seeking to invalidate the Act. Now the case is on appeal in the state’s highest court and we’ve filed a brief in support.

Defenders of Arizona’s law say it’s necessary to prevent the “holdout problem”—property owners who supposedly strategically refuse to sell at market price to compel extra compensation. In theory, such holdouts hinder economic development projects and their alleged trickle‐down effects.

But as we wrote in our brief, the fact that some people would rather see private property go to a supposed “better use” can’t justify confiscating it. The Founders were very worried that private interests might coopt government power for their own ends. In Calder v. Bull, 3 U.S. (3 Dall.) 386 (1798), Justice Samuel Chase wrote of a “law that takes property from A. and gives it to B.” and explained that “[i]t is against all reason and justice, for a people to entrust a Legislature with such powers.… The genius, the nature, and the spirit, of our State Governments, amount to a prohibition of such acts of legislation; and the general principles of law and reason forbid them.”

John Locke, whose works were very influential on the American founders, stated, “I have truly no property in that which another can by right take from me when he pleases against my consent.” William Blackstone, a similarly influential figure to early American jurists, said that an “absolute right, inherent in every Englishman, is that of property,” which cannot be violated “even for the general good of the whole community.”

The understanding that, as John Adams once said, “liberty cannot exist” without property rights led the Founders to draft the Fifth Amendment’s Takings Clause. That clause prohibits the taking of private property for private use and demands that, even when the government takes property for public use, it must offer property owners “just compensation.”

Unfortunately, the clause has been watered down over the years by a Supreme Court that has effectively written the words “public use” out of the Constitution and that now largely defers to governmental assertions that its property theft will lead to some public benefit. The results can be tragic.

In the infamous Kelo case, for example, the Court permitted the City of New London to confiscate Suzette Kelo’s little pink house to make way for a new business development spearheaded by Pfizer. Even after that tremendous legal battle, Pfizer abandoned its New London facility in 2009, costing New London 1,400 jobs.

A decade after the Kelo decision, the condemned properties at the center of it remained “empty and undeveloped,” occupied only by feral cats.

Kelo ignited popular pushback across the nation, including in Arizona, where residents passed the Private Property Rights Protection Act (PPRPA). In Cato’s brief, we argue that the Condominium Act is a quintessential private taking that violates the Arizona constitution and the PPRPA.

The Condominium Act is also terrible policy. Multiple studies have shown a strong connection between protection of property rights and economic well‐being, including increased income per capita. Nations with similar languages, cultures, and traditions have greatly disparate Gross National Income (GNI) per capita depending on their respect for property rights. South Korea’s GNI per capita is at least 17 times the income of North Korea’s, Finland’s is between 2.5 times and more than 7 times Estonia’s, and Taiwan and Hong Kong’s are both more than four times China’s. The sheer benefit of property rights justifies their enforcement.

Moreover, eminent domain abuse causes more harm than any holdouts supposedly cause. In the early 1990s, for example, Bremerton, Washington, settled a suit about odor complaints from a sewage treatment plant and agreed to install odor controls. The city then condemned 53 homes near the sewage treatment plant, including one owner’s home of 40 years, supposedly to create an odor easement. However, days after the condemnations were finalized, the city rezoned the land and sold it to a car dealership for $1.99 million. The city never created the easement.

In 1997, Hurst, Texas, used eminent domain to seize 127 homes to expand a real estate company’s mall, hoping to increase sales and property tax revenue. Ten couples, who had lived in those homes for as many as 30 years, sued to stop the condemnations. The trial judge refused to stay the condemnations while the suits were ongoing, so the residents lost their homes. The judge also refused an extension to a resident whose wife was in the hospital for brain cancer, forcing him to leave her bedside to move out his belongings. A total of three couples died and four others suffered heart attacks during the litigation. There was evidence that the land surveyor who designed the roads for the mall was told to change the path of one road to run through eight of the litigants’ houses. After years of litigation and receiving no compensation, the families were forced to settle.

In contrast, the holdout problem is not as problematic as some suggest; economic development has long managed to succeed despite holdouts. Some have even gone on to become cherished parts of the community.

In 1902, Macy’s decided to move its flagship New York store to the corner of 34th Street and Broadway. The new store was planned to cover the entire block. However, the owners of the competing Siegel‐Cooper Co. bought one parcel on the corner of the block to bargain for a lease of the old Macy’s location. Macy’s thwarted this plan by refusing to negotiate, and it instead built the store around the tiny parcel.

Macy’s has never owned the parcel since, but it advertised on the parcel’s exterior from the 1940s until Amazon outbid it in 2021. Despite Macy’s being unable to get part of the property it sought, it still successfully built the store and even leased the holdout parcel for advertising space.

When Wickham’s Department Store wished to expand onto the land of Spiegelhalter’s jewelry shop to create a grander structure, the jewelry store owners refused to sell. Ultimately, Wickham’s built its grand structure around Spiegelhalter’s. The resulting lopsided look became extremely popular. Decades after both stores shut down, when new developers planned to demolish Spiegelhalter’s and replace it with a tall, glass atrium, campaigns by local groups managed to get the developers to keep Spiegelhalter’s intact.

We detail several more examples of charming holdout stories that ended happily, all while respecting property rights, in our brief.

In sum, our Constitution, and Arizona’s, protects property owners’ ability to hold onto their property even when others would rather see it go to someone else for a purported better use. The Condominium Act directly contradicts that foundational principle. We hope the Arizona Supreme Court will agree.

Read our full brief here.