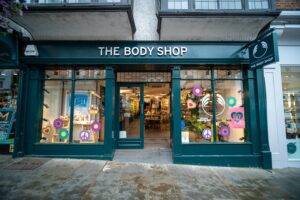

The high street beauty retailer Body Shop has agreed to sell its 250 stores in a £207million deal after struggling with profitability.

The retail outlets are being sold to a private equity group after owner Natura & Co reached a deal with Aurelius Group today.

The Brazilian cosmetics maker says the sale is set to be finalised by December 31. It is unclear if the sale will result in store closures or see staff made redundant.

Natura said the agreement includes a potential earn-out of £90million, adding that both the sale price and the earn-out would be paid within five years of the transaction closing.

The move represents the second major divestment by Natura this year as part of a broader organisational shakeup, following a deal announced in April to sell luxury brand Aesop to L’Oreal at an enterprise value of roughly £2billion.

Founded in 1976 by Anita Roddick in Brighton, the Body Shop has grown to have around 7,000 staff, and 900 stores in 20 different countries.

It also has around 1,600 franchised shops around the world.

Natura announced in August that its board of directors had authorised it to search for ‘strategic alternatives’ for The Body Shop, including a potential sale six years after buying it from L’Oreal.

The company entered into exclusive talks with Aurelius last month.

Natura’s Chief Executive Fabio Barbosa said the firm was ‘pleased to have found a strong home for The Body Shop to write the next chapter in its remarkable story’.

He said in a statement: ‘We extend our sincerest thanks to all The Body Shop’s associates, who contributed immensely to broadening Natura & Co’s horizons. We wish them continued success under the stewardship of Aurelius.’

The private equity buyer, Aurelius, said that it would have an opportunity to ‘re-energise’ the retailer.

‘We are delighted to be undertaking this acquisition of an iconic British brand, which pioneered the cruelty-free and natural ingredient movement in the health and beauty market,’ said Aurelius partner Tristan Nagler.

‘We look forward to working with CEO Ian Bickley and his team to drive operational improvements and re-energise the business, and help to deliver the next chapter of success.’

Body Shop chief executive Mr Bickley echoed: ‘The Body Shop is not only a beauty brand, but also an iconic social business that has captured hearts in nearly every corner of the world.

‘We are deeply grateful to Natura & Co for their unwavering support and I’m looking forward to working hand in hand with Aurelius as we adapt and flourish in new global retail environments, always with an eye on sustainable and profitable growth.’

Mr Barbosa added that the sale of The Body Shop would allow his company to refocus its business and concentrate on the Latin American markets.

Natura rapidly grew through high-profile acquisitions, including the purchases of The Body Shop, Aesop and Avon International, but ended up struggling with profitability.

That led it to launch a quest for ‘discipline’ and deleveraging last year in order to return to profit.

In the third quarter, Natura & Co reported a net profit of approximately £1.15billion, swinging back from a £450million-real loss a year earlier and boosted by the sale of Aesop.

Without that divestiture, Natura said, third quarter net profit would have been around £123million.

Read more:

High street beauty retailer The Body Shop with 250 stores is sold in £207M deal