Nicholas Anthony

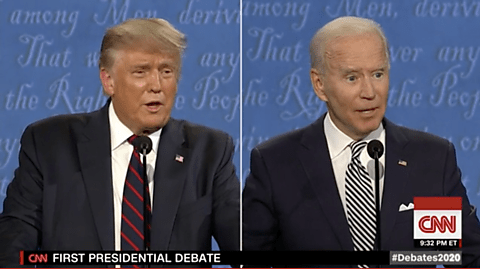

Former President Donald Trump made headlines when he spoke out against the creation of a U.S. central bank digital currency, or CBDC. Yet, he’s not alone in taking this stance.

The news of Trump’s stance broke on January 17 when he announced in New Hampshire that “I am also making another promise to protect Americans from government tyranny. As your president, I will never allow the creation of a central bank digital currency.”

Trump later credited former candidate Vivek Ramaswamy—who spoke out against CBDCs throughout much of his campaign—for alerting him to the risks of CBDCs. In fact, former candidate Ron DeSantis also made opposition to CBDCs part of his campaign. Prior to running for president, DeSantis, as the governor of Florida, went so far as to ban Americans from being able to use a CBDC in the state of Florida.

Yet, Republicans have not been the only source of opposition in the 2024 election campaign. Independent, and former Democrat, candidate Robert F. Kennedy Jr. openly opposed CBDCs because of how much power they could give governments and how governments have abused their powers in the past.

Where Does Biden Stand in the CBDC Debate?

President Joe Biden, on the other hand, has been silent on the issue as of late, but that wasn’t always the case.

In March of 2022, President Biden issued Executive Order 14067 to place “the highest urgency on research and development efforts into the potential design and deployment options of a United States CBDC.” In September 2022, the White House said that the reports issued under Executive Order 14067 “encourage the Federal Reserve to continue its ongoing CBDC research, experimentation, and evaluation and call for the creation of a Treasury‐led interagency working group to support the Federal Reserve’s efforts.”

The Biden administration also announced that it had “developed policy objectives for a US CBDC, which reflect the federal government’s priorities.” Going further, the Biden administration published a technical evaluation for a potential US CBDC.

However, the Biden administration has largely gone quiet since the campaign cycle kicked off. For example, in August 2023, a White House official told Bloomberg that National Economic Council Director Lael Brainard “has no position on a potential digital currency.” Yet as Bloomberg’s Christopher Condon correctly pointed out, this response was strange given Brainard had been the leading proponent of CBDCs at the Federal Reserve for years before being picked by President Biden to join the National Economic Council as his advisor.

One explanation for this distancing may be because, as POLITICO’s Victoria Guida noted, “The prospect of a [CBDC] has become increasingly politically toxic.” So it may be that President Biden has temporarily backed off the issue in recognition that it would be damaging at the polls as more Americans become aware of the issue. Or, perhaps he has since recognized the risks of CBDCs.

If it is the case that the Biden administration has come to recognize that the risks of CBDCs outweigh any purported benefits, it should speak out sooner rather than later.

Conclusion

Monetary and financial policy doesn’t usually make its way to the presidential debate stage, but the issue of a US CBDC is something that moderators should bring up. CBDCs pose a fundamental threat to Americans’ privacy and freedom. They deserve to know if, and how, the next president plans to mess with their money.