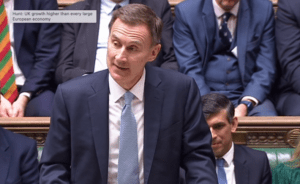

Jeremy Hunt is delivering his spring budget with one eye on a looming general election later this year. The Conservatives have said they want to reduce the tax burden on British workers and improve economic growth.

However, official forecasts have indicated that the chancellor has much less to spend than expected, which has forced him to draw up plans to raise some taxes and cut government spending.

What are the key points of Jeremy Hunt’s spring budget?

Windfall Taxes: The levy on the profits of energy companies has been prolonged by another year until 2029. This extension increases the total tax on North Sea oil and gas companies to 75 per cent and to 45 per cent for electricity generators. The chancellor expects this move to generate £1.5 billion in revenue.

Vaping Levy: A tax on the liquid used in vapes will be implemented starting October 2026. This measure aims to discourage non-smokers from taking up electronic cigarettes. To ensure that vaping remains a cheaper alternative, there will be a one-off increase in tobacco duty.

Second Homes: Tax breaks for second home owners profiting from holiday lets will be eliminated. Currently, landlords are permitted to deduct tax for assets used in short-term rental properties, such as furniture.

NHS Spending: The budget allocates £3.4 billion for the overhaul of old NHS IT systems. This investment is expected to unlock savings of £35 billion and reduce the 13 million hours lost annually by doctors and nurses due to outdated computer systems. The aim is to modernize NHS infrastructure and improve efficiency within the healthcare system.

Isa Reform: A new British Individual Savings Account (Isa) will be introduced, allowing an additional £5,000 annual tax-free savings allowance for investments in UK equities, on top of the existing Isa allowances. This move aims to encourage investment in the UK economy.

Fuel Duty: Fuel duty has been frozen for the 14th consecutive year. Additionally, the chancellor has kept in place a 5p cut to petrol taxes that was introduced in 2022 to alleviate the cost of living crisis. This measure is expected to save the average car driver £50 next year.

State of the Economy: The Office for Budget Responsibility (OBR) forecasts that the UK economy will expand by 0.8% this year, 1.9% next year, and 2% in 2026. These projections are higher than the previous forecasts of 0.7%, 1.4%, and 2% growth, respectively, made in November. The OBR also predicts that inflation will fall below 2% this year, down from the current level of 4%.

Alcohol Duty: The freeze on alcohol duty has been extended for a further six months until February 2025. This move is expected to benefit 38,000 pubs across the UK, providing relief to the hospitality sector.

More to come…

Read more:

Spring budget 2024 key highlights