Chris Edwards

President Biden’s new federal budget proposes high spending and huge deficits for years to come. The deficits are expected to boost government debt held by the public from $28 trillion this year to $45 trillion by 2034.

The budget baseline—which excludes Biden’s proposed policies—shows slightly higher debt growth over the coming decade. The Wall Street Journal reported, “The fiscal 2025 budget would cut the deficit by $3 trillion over the next decade,” and the Committee for a Responsible Federal Budget said, “President Biden does deserve praise for putting forward a comprehensive budget proposal that not only offsets new spending and tax breaks but would also reduce budget deficits by $3.3 trillion through 2034.”

But the Biden budget uses common accounting tricks to make the federal debt disaster look slightly less disastrous. One trick is pretending that nondefense discretionary spending drops sharply in the later years of the 10‐year budget horizon. It would be great if Biden’s policies were laying the groundwork for such discretionary spending cuts, but they are not.

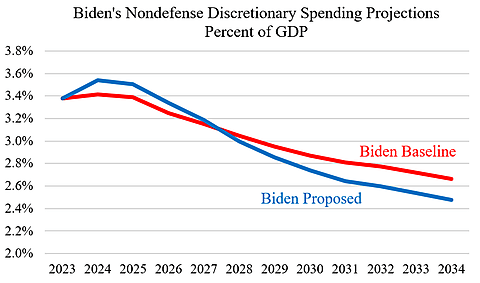

The chart shows the nondefense discretionary baseline and Biden’s proposed spending relative to gross domestic product (GDP). Proposed spending is above the baseline in the early years because that’s the spending Biden actually wants right now. Then in later years, proposed spending falls below the baseline to generate supposed savings. Those fake savings reduce the 10‐year deficit totals, which the White House knows that reporters and think tanks focus on.

If nondefense discretionary spending remained at this year’s level of 3.5 percent of GDP, it would add about $2.5 trillion to deficits by 2034, including higher interest costs. That would be roughly a normal level for this category of spending, which has averaged 3.7 percent of GDP over the past five decades. I favor far lower spending, but 3.5 percent of GDP seems like a more realistic projection for Biden given his demonstrated big‐spending approach. In other words, Biden has shown that he actually favors 3.5 percent of GDP, yet his budget pencils in out‐year figures that pretend to be much more frugal.

Another accounting trick in the Biden budget is assuming that the proposed expansion of the child tax credit lasts just one year. If the budget had accounted for permanent extension, it would have added about $2 trillion to 10‐year deficits.

Just these two accounting tricks total more in added spending than the $3 trillion that Biden gets praise for supposedly saving. The upshot is that 10‐year presidential budget projections seem useless as indicators of fiscal discipline.

For further comments on Biden’s budget and federal spending, see the following: “President Biden’s Proposed Budget,” “The Fiscal Situation of the United States,” “How the Federal Government Spends $6.7 Trillion,” and “Reviving Federalism to Tackle the Government Debt Crisis.”