Chris Edwards

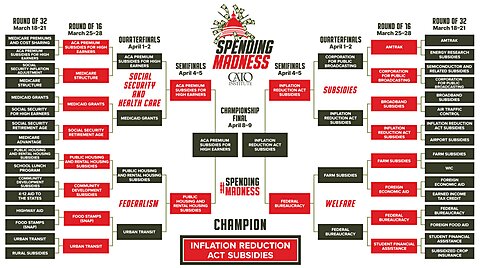

After five rounds, tens of thousands of online voters have chosen the most wasteful federal program: the subsidies and tax breaks in the Inflation Reduction Act (IRA) of 2022. The results from Spending Madness suggest that the highest priority budget cut for Congress is the vast corporate welfare unleashed by the IRA.

The law is flooding the economy with $1 trillion of spending subsidies and narrow tax breaks for corporations across many industries, including energy, batteries, and automobiles. It was signed into law by a president who regularly criticizes tax breaks for big corporations yet has increased corporate tax loopholes by 92 percent.

The federal government has been subsidizing energy schemes since at least the 1970s, and there are many failures. Scott Lincicome has described the corruption problem of business subsidies. If the IRA subsidies are not repealed, we expect many failures and scandals in the months and years ahead.

Adam Michel and Travis Fisher note that the estimated cost of the IRA has tripled since the law was passed. Congress should at least cut IRA subsidies to match the original estimated costs, but over the longer term, it should phase out all energy subsidies and allow competition on a level playing field. Investors and entrepreneurs in open markets would continue to pursue innovations in cleaner fuels, batteries, automobiles, and other technologies.

Spending Madness 2024 profiled 32 budget cuts to get federal debt under control. Congress should cut every part of the budget, including Social Security, health programs, aid to the states, business subsidies, and welfare. Romina Boccia has suggested strategies to get reforms underway, and Downsizing the Federal Government discusses cuts to dozens of federal agencies.

The latest Congressional Budget Office projections show the government adding $20 trillion of debt in the coming decade, and experts are warning that interest rates on the debt could spike. Now is the time for Congress to begin cutting, and the programs profiled in Spending Madness are a great place to start.

Thanks to everyone who participated in Spending Madness 2024.