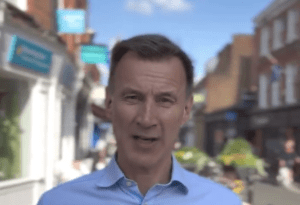

Chancellor Jeremy Hunt has declared inheritance tax unfair and “profoundly anti-Conservative,” committing to support the middle classes with tax breaks.

In an interview with The Telegraph, Hunt emphasised the Conservative Party’s commitment to ending taxes that discourage earning and saving, vowing to build on recent National Insurance cuts.

In his first interview since Prime Minister Rishi Sunak called a snap election on July 4, Hunt outlined a Tory manifesto focused on tax cuts designed to stimulate growth. He highlighted the need to reduce “taxes on work” and those that “disincentivise saving,” aiming to create a more favourable economic environment for workers and savers alike.

Hunt’s comments come amid warnings from private schools that parents are withdrawing children in anticipation of Labour’s pledge to add VAT to school fees. Labour leader Sir Keir Starmer has promised to prioritise this tax change from “day one” of a Labour government, intending swift implementation.

In contrast to Labour’s tax plans, Hunt indicated that the Conservatives would seek to abolish the effective 60% tax rate on incomes between £100,000 and £125,140, caused by the tapering of the tax-free personal allowance. He stressed the importance of allowing workers to retain more of their earnings, reiterating goals to abolish National Insurance, transition more people from welfare to work, and enhance home ownership support.

“Our priority will be taxes that boost growth,” Hunt stated. “This includes business taxes that encourage investment and taxes on work. Our National Insurance cuts are designed to address one in five vacancies across the economy. We also need to address taxes that disincentivise saving to encourage more investment in the economy.”

Hunt firmly rejected the idea of introducing a wealth tax, pledging, “There will be no wealth taxes under a Conservative government.” He described inheritance tax as “pernicious,” arguing that it discourages saving for the future and contradicts Conservative principles.

While Hunt considered reducing inheritance tax last year, potentially halving the rate from 40% to 20%, he refrained from committing to specific manifesto pledges. He emphasised that his “first priority” is cutting taxes with the greatest impact on economic growth.

Addressing whether cutting inheritance tax is a priority, Hunt responded, “I hope it’s something that over time a Conservative government would be able to look at.” He underscored the greater importance of making work pay and moving people from welfare to work, including reducing marginal tax rates for earnings above £50,000 as benefits like Universal Credit are withdrawn.

This stance highlights a clear Conservative strategy focused on tax reforms aimed at boosting growth, encouraging savings, and supporting the middle classes, while drawing a distinct line against Labour’s proposed tax changes.

Read more:

Inheritance Tax Conflicts with Conservative Values, Says Hunt