In the rapidly evolving global market, British companies face growing pressure to expand beyond traditional markets in Europe and North America.

One of the most promising regions for this expansion is Southeast Asia, a dynamic and rapidly developing part of the world. With increasing urbanization, a burgeoning middle class, and a growing demand for technology and financial services, Southeast Asia presents a strategic opportunity for British businesses.

Southeast Asia, which includes countries like Thailand, Vietnam, Malaysia, Singapore, and Indonesia, offers a diverse set of markets that are not only growing but also providing unique advantages for foreign companies. British businesses, in particular, can leverage this momentum by exploring opportunities in key sectors such as technology, financial services, and manufacturing.

Cost of Living Index: The Competitive Advantage for British Firms

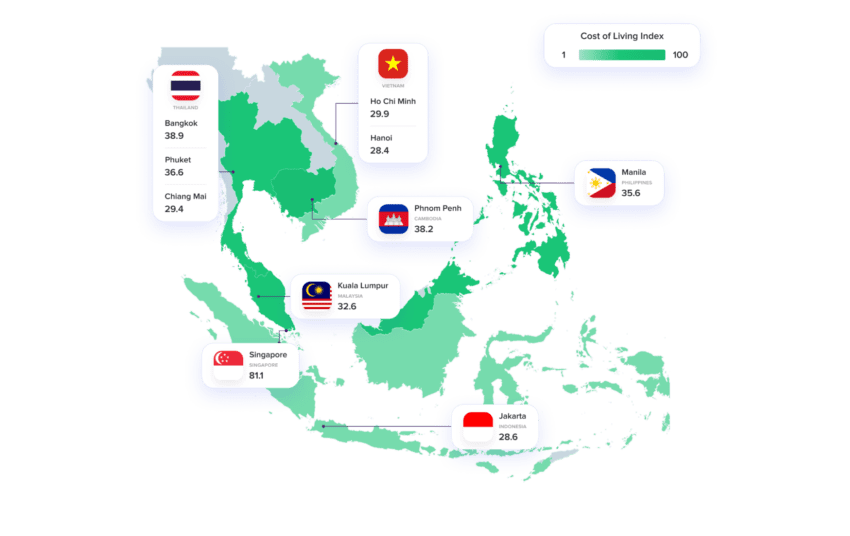

One of the primary reasons British companies should explore expansion into Southeast Asia is the significant cost advantage the region offers. The Cost of Living Index across various cities in the region highlights that British firms can save substantially on operational costs, including labor, office space, and day-to-day business expenses.

The Cost of Living Index in Southeast Asia compares key cities, including Chiang Mai, Ho Chi Minh City, and Jakarta. While the cost of living in Singapore remains high with an index of 81.1, cities like Chiang Mai (29.4), Ho Chi Minh City (29.9), and Jakarta (28.6) offer significantly lower costs. This presents an excellent opportunity for British businesses to expand their operations in cities where the cost of doing business is more affordable, while still gaining access to a highly skilled workforce and expanding consumer markets.

For instance, Chiang Mai, with its affordable cost of living and growing tech scene, has emerged as a hub for startups and tech companies. British firms can set up regional offices, development centers, or manufacturing units at a fraction of the cost compared to London or even Singapore, without compromising on the quality of talent.

Access to a Young and Growing Workforce

The workforce in Southeast Asia is not only young but also increasingly well-educated and tech-savvy. With a large proportion of the population under 35, cities like Ho Chi Minh City and Bangkok are becoming hubs for technology and innovation. British companies can tap into this talent pool to support their expansion plans. Additionally, the affordability of living in cities such as Chiang Mai and Kuala Lumpur enables companies to attract and retain skilled employees, providing a competitive edge over operating in more expensive markets.

In comparison to the UK, where labor costs are considerably higher, expanding to Southeast Asia allows businesses to benefit from lower wages while still maintaining access to highly skilled professionals. The region’s young and eager workforce can drive innovation and support the long-term growth plans of British firms.

Growing Middle Class and Consumer Demand

One of the most significant economic trends in Southeast Asia is the rise of the middle class. As millions of people move into higher-income brackets, their demand for goods and services is growing exponentially. This presents a lucrative opportunity for British companies to introduce their products and services to a rapidly expanding consumer base.

The rise of the middle class is particularly evident in cities like Ho Chi Minh City, Jakarta, and Kuala Lumpur, where consumer spending is on the rise. British companies in industries such as consumer goods, financial services, and technology are particularly well-positioned to take advantage of this growing demand. Expanding into these markets allows British firms to increase their global footprint while capitalizing on the increasing purchasing power of Southeast Asian consumers.

Tech Innovation and Financial Services

Southeast Asia is at the forefront of digital transformation, particularly in the areas of financial services and technology. Countries like Singapore and Malaysia are leading the charge in fintech innovation, while cities like Ho Chi Minh City and Bangkok are emerging as tech hubs. For British companies in the fintech and technology sectors, this presents an opportunity to expand their offerings and collaborate with regional innovators.

The fintech sector, in particular, has seen significant growth in Southeast Asia, driven by a young, tech-savvy population and increasing access to digital services. British fintech firms can benefit from entering these markets, where demand for digital banking, payment systems, and financial inclusion services is growing rapidly. Establishing partnerships with local fintech startups or expanding operations in cities like Kuala Lumpur and Jakarta can help British firms tap into this growth.

Moreover, Singapore’s rise as a global financial hub offers British financial services companies a gateway into the region. Although Singapore has a higher cost of living, its status as a financial powerhouse provides British companies with the infrastructure and network to enter Southeast Asia’s booming financial services market.

Regional Integration and Government Support

Southeast Asia is also benefiting from increasing regional integration, which is creating a more seamless business environment for foreign companies. Organizations like the Association of Southeast Asian Nations (ASEAN) are promoting economic cooperation and trade among member states, making it easier for British companies to expand across multiple markets in the region.

Additionally, governments across Southeast Asia are actively courting foreign investment and offering incentives for businesses to establish operations in their countries. For example, Thailand and Vietnam have introduced favorable tax policies, grants, and other incentives aimed at attracting foreign companies, particularly in the technology and manufacturing sectors. This provides British firms with a more conducive business environment and fewer barriers to entry compared to other parts of the world.

Conclusion

As British companies seek to diversify their global operations, Southeast Asia presents a compelling case for expansion. With its lower cost of living, growing middle class, tech-savvy workforce, and supportive government policies, the region offers numerous advantages for businesses across industries. Cities like Chiang Mai, Ho Chi Minh City, and Jakarta provide British firms with affordable entry points into a dynamic and growing market.

By exploring opportunities in Southeast Asia, British companies can capitalize on the region’s growth and innovation, positioning themselves for long-term success in one of the world’s most exciting economic regions.

This report by ROSHI highlights the company’s leadership in Southeast Asia’s digital lending sector. ROSHI provides a wide range of financial products customized to address the needs of consumers in Singapore. Their offerings include comparing home loan rates and online loans in Singapore, aimed at delivering flexible and accessible financing solutions.

Read more:

Why More British Companies Should Explore Expansion into Southeast Asia