Marc Joffe

The baseball club formerly known as the Oakland A’s has begun an odyssey that should ultimately take it to Las Vegas in the late 2020s. But the team may need to shake down Nevada taxpayers for even more money before finishing its journey. Professional sports, in which wealthy owners employ well-compensated players to compete in front of disproportionately affluent crowds, may seem like the least eligible business for taxpayer-funded government largesse, but somehow the subsidies keep coming.

Until the early 20th century, US stadiums were normally funded privately. But in 1928, Cleveland, Ohio voters approved a $2.5 million bond measure to fund the construction of Cleveland Municipal Stadium, kicking off the Depression-era trend toward publicly funded construction. Although the stadium was part of a failed effort to attract the 1932 Olympics, it soon became the home of the MLB Cleveland Indians and later the NFL Cleveland Browns. The facility was demolished in 1995, only 64 years after it opened, a fact that throws cold water on the notion that big municipal infrastructure projects are generational investments benefiting residents far into the future. Instead, stadiums rapidly become obsolete, necessitating either replacement or costly makeovers.

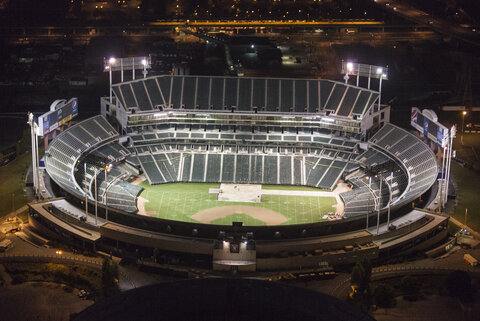

Such was the case with the Oakland Coliseum, which opened in 1966, became the home of the A’s in 1968, and was considered obsolescent long before the A’s finally left in 2024. The Coliseum and adjacent Oakland Arena have been encumbered by municipal bond debt throughout their entire existence.

Oakland hopes to finally extinguish the debt and plug its large FY 2025 budget deficit by selling the site to the African American Sports & Entertainment Group. However, there are doubts about whether this transaction will be completed. These doubts contributed to Fitch Ratings’ decision to downgrade the city two notches from AA- to A.

After extended negotiations with Oakland officials over a new stadium site, the A’s management walked away from the negotiating table and declared its intention to move. Their first stop is a small stadium in West Sacramento, California, which they will share with the San Francisco Giants’ AAA team for at least three years. That stadium, now known as Sutter Health Park, was also built with municipal bond proceeds. But, to the credit of Sacramento-area local governments, that debt can only be serviced with stadium proceeds, leaving taxpayers (at least theoretically) off the hook.

The move brings some drawbacks to the “no-longer Oakland” A’s. The minor league facility is very small by major league baseball standards, limiting attendance to only about 14,000 fans. Further, because the A’s are new to Sacramento and are staying temporarily, they may not be able to cultivate a dedicated fan base. As a result, they may struggle to sell out those 14,000 seats once the novelty effect wears out over the first few home games.

The small stadium and unfamiliar community will likely cement the A’s standing near the bottom of MLB stadium attendance. For the 2024 season, the A’s ranked dead last in attendance, with an average of 11,528 fans coming to its home games.

Depressed ticket and concession revenue will hurt the team’s financial performance as it prepares to move to its permanent new home in Las Vegas. Forbes reports that the A’s lost $11 million in 2023 despite its relatively low payroll, and it is reasonable to think that the losses will continue during the franchise’s time in West Sacramento.

Nevada and Clark County lured the A’s to Las Vegas by offering to contribute $380 million to the cost of building a new domed stadium near the Las Vegas strip. The 33,000-seat facility was originally expected to cost a total of $1.5 billion to construct, but the budget has now escalated to $1.75 billion due to inflation and added amenities.

The A’s owner has assured Nevada lawmakers that he can take on the added costs, and the contractual agreement between the team and the new Las Vegas Stadium Authority appears to strictly limit the taxpayer contribution to $380 million. However, given the team’s financial status and the owner’s previous machinations in Oakland, one has to wonder whether he will attempt to extract further concessions if construction costs escalate further.

But regardless of whether the taxpayer damage is limited to “just” $380 million or goes higher, officials in Las Vegas and beyond should consider the academic research on stadium subsidies. As economists John Charles Bradbury, Dennis Coates, and Brad R. Humphrey concluded in their 2023 study of stadium subsidies:

The extensive body of research on the economic impact of stadiums demonstrates that professional sports venues generate limited economic and social benefits, which fall far short of the large public subsidies they typically receive. Stadium subsidies transfer wealth from the general tax base to billionaire team owners, millionaire players, and the wealthy cohort of fans who regularly attend stadium events. Despite the widespread consensus among economists that stadium subsidies represent poor public policy, state and local governments continue to subsidize venue construction with funding that now routinely exceeds $1 billion per new facility.

We can only hope that politicians and voters elsewhere will listen to this wisdom.