Adam N. Michel

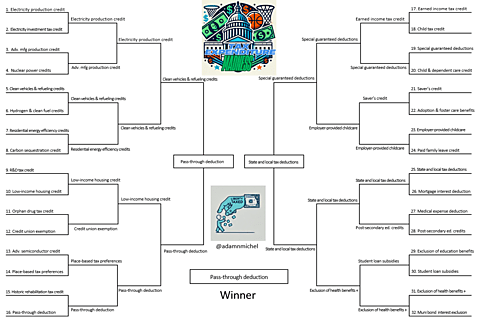

After five rounds of voting, the pass-through tax deduction was chosen as the worst tax expenditure. The 20 percent business deduction arbitrarily favors certain types of businesses over others and adds tremendous complexity to the tax code. The results from the Tax Expenditures Madness bracket suggest that Congress fundamentally rethink how the United States taxes business income.

You can read more about the contest here and find descriptions for all 32 tax expenditures in the bracket here.

What is a pass-through business?

Businesses are broadly taxed in two different ways. A pass-through business passes its profits through to its owner’s income tax return and thus pays taxes at individual income tax rates—the top individual income tax rate is 37 percent in 2025. C corporations pay the federal corporate income tax rate of 21 percent on business entity-level profits. When those profits are distributed or realized through stock sales, the 20 percent top tax rate on capital gains and dividends applies.

C corporations tend to be the larger, publicly traded businesses most Americans know as household names. Pass-through businesses tend to be smaller, privately owned, and take the legal forms of partnerships, sole proprietorships, limited liability companies (LLCs), Subchapter S corporations, regulated investment companies (RICs), and real estate investment trusts (REITs).

Over the past half-century, the pass-through sector has grown as a share of businesses in the United States and as a share of all business profits. The Tax Foundation’s Huaqun Li shows that in 1980 C corporations comprised 17 percent of businesses and earned 75 percent of business profits. In 2020, C corporations were 4 percent of businesses and earned 42 percent of business profits. Pass-throughs also employ a majority of the private sector workforce.

What is the pass-through deduction?

Congress created the Section 199A deduction for pass-through businesses as part of the 2017 Tax Cuts and Jobs Act. The provision allows individuals to deduct 20 percent of qualifying net business income. Certain high-income service providers in health, law, consulting, athletics, financial, and brokerage services are denied the deduction. Phaseouts and other complicated limitations also apply. For qualifying businesses, the deduction lowers most pass-throughs’ top marginal income tax rate from 37 percent to 29.6 percent.

Passive income from pass-throughs and C corporation shareholders above a $200,000 threshold ($250,000 for married filers) is also subject to the 3.8 percent net investment income tax (NIIT).

Proponents of the 199A deduction argue that it is necessary to create tax parity between pass-through businesses and C corporations. Often, the comparison is made between the 21 percent corporate tax rate and the 37 percent top individual income tax rate. However, the comparable rate for large C corporations must also account for the 20 percent capital gains and dividend taxes assessed on realized and distributed profits. Taken together, the total tax rate on corporate income is 36.8 percent, which is very similar to the top rate of 37 percent paid without the special pass-through deduction.

This simple comparison abstracts away from many other intervening particularities in how different business forms distribute or retain profits, pay employees, and finance capital raising. Attempting to account for many of these variations, Kyle Pomerleau concludes “that under current policy, pass-through business profits face a lower tax burden than do other forms of income, such as wages and certain types of corporate profits. In addition, pass-through business investment, on average, faces a lower tax burden than does corporate investment.” Using different assumptions and assuming tax rates go up in 2026, some pass-throughs could be disadvantaged next year relative to larger C corporations whose tax rate reduction is permanent.

The differences in business tax rates, depending on organizational structure, violate key principles of tax design, namely that we should treat similarly situated taxpayers similarly (horizontal equality). To fix this disparity for some taxpayers, the pass-through deduction adds additional tax complexity, includes perverse economic incentives as guardrails phase in, and creates new opportunities for economically costly tax planning. A deduction cannot fix our tax system’s structural flaw that applies two vastly different sets of tax rules to similar business types.

Fixing business taxation

The remedy to the bifurcated business income tax is some form of “corporate integration” that treats all business profits similarly. Policymakers could tax all business income at the business level, tax all income at the individual level, or pursue a hybrid system. Travis Nix and I reviewed eight different forms of full or partial business integration, each with different advantages and complications.

Kyle Pomerleau describes how integration would go a long way towards equalizing the tax treatment of businesses and “can also eliminate the incentive for business owners to reclassify income for tax purposes, greatly reduce the tax code’s bias in favor of borrowing, and could generally improve investment incentives, which would lead to a larger economy and higher incomes for Americans.”

The results from our Tax Expenditure Madness bracket emphasize how the 2025 expiration of the pass-through deduction is an opportunity for Congress to more fundamentally reconsider how the US tax code treats all business income.