We’ve all heard the classic market maxim, “Sell in May and go away.” For many investors, that’s the introduction to market seasonality that suggests a six-month period where it’s just best to avoid stocks altogether.

Through my own experience, complemented with interviews with seasonality experts like Jeff Hirsch of the Stock Traders Almanac, I’ve learned to treat seasonal patterns as tendencies instead of certainties. Seasonal patterns tell you what is likely to happen, barring any external forces that would cause the markets to deviate from their normal seasonal patterns.

“Sell in May” is Really About Weakness in Autumn

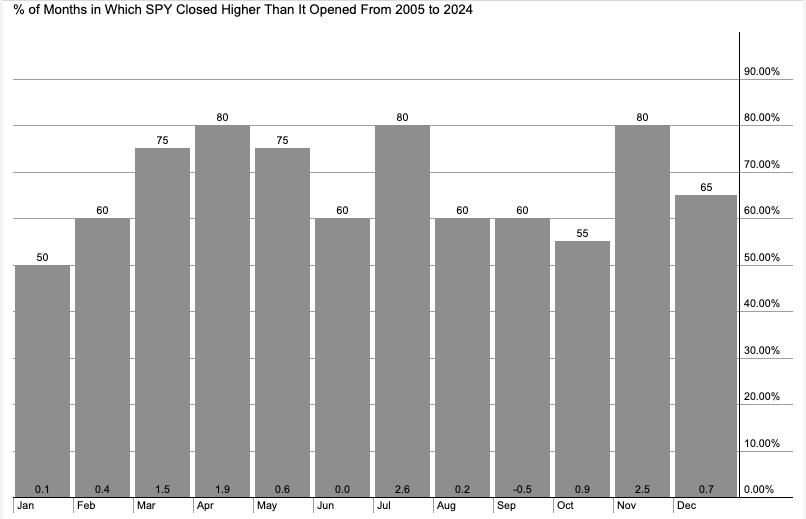

We can use the seasonality charts on StockCharts to try and identify patterns going back through years of market history. We’ll start with 20 years of data, from 2005 to 2024. Each bar represents the percent of the observations where the month ended higher than it began. The numbers found at the bottom of each bar shows the average return for that calendar month based on the years in question.

Going back for the last 20 years, we can see that the March-April-May period is actually fairly strong. Those months have been up 75-80% of the time, representing the most consistent three-month period of all. But did you notice how the next five months, with the exception of a pretty strong July, are basically the weakest part of the year?

Join us for a FREE webinar on Wednesday 5/21 at 1:00PM ET as we present “Sell in May 2025: Seasonal Strategy or Outdated Myth?” We’ll dig deeper into the history of “Sell in May,” analyze summer trends in recent years, and focus on signs to follow in the weeks and months ahead! Sign up HERE for this free event!

It turns out that the reason why “sell in May” has often worked out is less about May being super weak, but more about how major lows have usually come in the fall months. Since the COVID low in early 2020, we’ve experienced major lows in September or October every year except for 2024.

Spring and Early Summer Have Been Crazy Strong

When we focus on the last five years, we can see that the May-June-July period has been consistently strong. In fact, May and July have seen bullish trends every year since 2019. So, while investors often talk about the “summer doldrums” and weakness into the hot summer months, the recent evidence would suggest otherwise.

The weakest months since the COVID low have actually been January, February, September, and October. So again, it’s been less about weakness in the spring, and much more about weaker price action into the traditional low in September or October. Also note the strength in November, where the market is almost always rallying off a major low and setting up for a positive finish to the calendar year!

Will 2025 Follow the Normal Seasonal Pattern?

As I mentioned earlier, I like to think of seasonal patterns as tendencies. There is no guarantee that July will be strong, and there is no way I can tell you for sure that the market will make yet another major low in September. Seasonality tells you the general bias to the markets, but mindful investors know the most important evidence is price itself.

Given the extreme rally off the early April low, we’ve seen a rapid rotation from bearish sentiment to more bullish outlooks as investors have started to believe in the new uptrend phase. This week’s price gap higher for the S&P 500 could provide a perfect support range to monitor in the coming weeks and months.

If the S&P 500 is able to hold 5750 and remain above the support range set from the gap earlier this month, then perhaps the equity markets will follow the same pattern as recent years and remain strong into August. If, however, the S&P 500 is unable to hold this key support range, and we also confirm that breakdown with weaker momentum readings and deteriorating breadth conditions, then the S&P 500 may be charting a new course through what has become a strong period in the calendar year.

RR#6,

Dave

P.S. Ready to upgrade your investment process? Check out my free behavioral investing course!

David Keller, CMT

President and Chief Strategist

Sierra Alpha Research LLC

marketmisbehavior.com

https://www.youtube.com/c/MarketMisbehavior

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional.

The author does not have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author and do not in any way represent the views or opinions of any other person or entity.