Richard Caring has apologised to suppliers of his restaurant businesses after a letter was sent out informing them there would be a “mandatory” 2.5 per cent cut to their invoices.

Caring’s restaurant empire, which includes The Ivy Collection and Bills, wrote to suppliers earlier this month telling them that “to ensure our business can remain strong” a 2.5 per cent “discount” would be applied to their accounts.

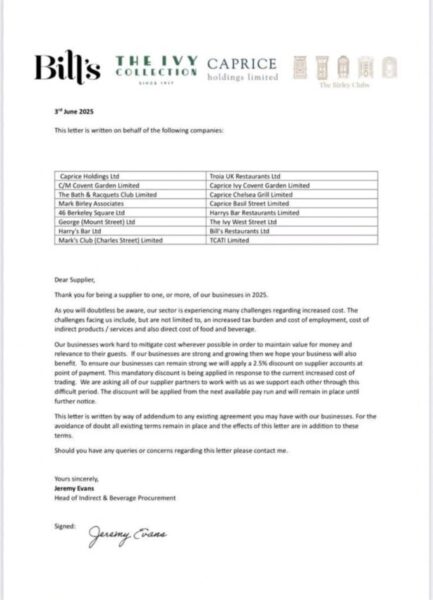

“This mandatory discount is being applied in response to the current increased costs of trading,” the letter, dated June 3 and signed by Jeremy Evans, Richard Caring’s head of indirect and beverage procurement, said. “We are asking all of our supplier partners to work with us as we support each other through this difficult period.”

After suppliers baulked at the unilateral demand for a discount, Caring told The Times that the letter had not been approved and apologised for it, adding that it was “totally incorrect”.

“This letter should not have been written in the manner that it was. I had not seen it and certainly had not approved it. I want to apologise to our suppliers for the letter, which is totally incorrect,” Caring said.

“I want to make it clear that at no time would we put this into operation without the full agreement of each supplier and at no time should we have suggested a mandatory positioning.”

It is understood that the idea of the cuts are not being reversed entirely, but the company will work with each of its suppliers to come to a decision.

Nicholas Harmston, the chief executive and founder of We Can Source It, a catering supplier which received the letter, said he wrote back to tell them that he would increase his prices by 2.5 per cent and reduce the company’s credit terms.

“I couldn’t believe it. In 11 years of supplying [businesses], I’ve never seen a letter like that. It was unbelievable,” Harmston said. “I’ve had no response [to my letter]. There was absolutely no way that was going to be accepted by my company, and I don’t suppose many other suppliers will accept it either.”

At the time, the conglomerate justified the increase due to the “many challenges regarding increased cost” that the restaurant sector is facing.

“The challenges facing us include, but are not limited to, an increased tax burden and cost of employment, cost of indirect products/services and also direct costs of food and beverages,” the letter went on to say. It ended by telling suppliers with concerns or queries to contact the business.

“I want to enlarge on the part of the letter that says if any supplier has any queries or concerns they should contact me,” Caring added. “I would say we would like to work with each supplier in what is an extremely difficult marketplace so that we can successfully work together into the future hand in hand.”

The apology comes as Caring is in advanced talks to sell a significant portion of his UK hospitality empire to an entity controlled by Sheikh Tahnoon bin Zayed al-Nahyan. According to the Financial Times, the deal between Caring and Sheikh Tahnoon’s holding company, IHC, could exceed £1 billion.

Read more:

Ivy owner apologises for demanding discounts from suppliers