UK chancellor Jeremy Hunt has said he will consider selling the government’s remaining shares in NatWest to the general public in the next 12 months as part of his Autumn Statement on Wednesday.

The Treasury still owns 39 per cent of the UK high street bank as the result of a £45.5bn bailout of the lender during the financial crisis in 2008, when it was known as Royal Bank of Scotland. The government has steadily reduced its stake from a peak of 84 per cent but is unlikely to ever recover the full value.

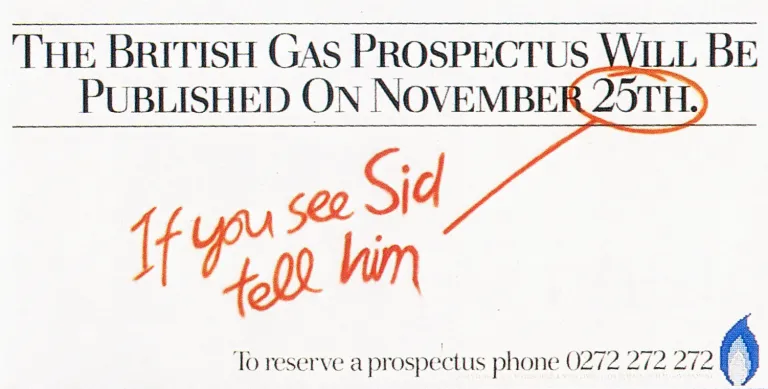

“It’s time to get Sid investing again,” Hunt said, referring to an advertising campaign used to promote a privatisation drive by Margaret Thatcher’s government in the 1980s. The ubiquitous “Tell Sid” adverts encouraged taxpayers to buy discounted shares in the £5.6bn flotation of British Gas in 1986, which they did by attaching a cheque to a newspaper coupon.

Hunt said the NatWest plan was “subject to market conditions and achieving value for money” and that the government wanted to fully exit its investment in 2025 or 2026.

However, NatWest shares have performed poorly this year, shedding 25 per cent due to disappointing earnings and the departure of chief executive Dame Alison Rose in the wake of a campaign by Nigel Farage.

The former UK Independence and Brexit party leader revealed in July that he had been cut off by NatWest’s private banking arm, Coutts, in part because its reputation risk committee decided that his political views did not align with its values.

NatWest shares dropped about 1 per cent to 205p after Hunt’s speech. The stock trades at a steep 50 per cent discount to the book value of the bank’s assets.

“We welcome the government’s continued commitment to returning NatWest to private ownership and believe this is in the best interests of the bank and our shareholders,” NatWest said.

Since its 2008 rescue, NatWest has closed most of the international and investment banking operations that led to its bailout and it is now primarily a high-street retail and business lender. It rebranded from RBS in 2020 to break with the toxic legacy.

This is not the first time a Conservative government has floated the idea of selling a bailed-out bank’s stock to the public. In 2015, then-chancellor George Osborne said in an election manifesto that the remaining 9 per cent stake in Lloyds Banking Group would be sold to the public, only to withdraw the offer a year later.

Read more:

Hunt ‘brings back Sid’ as he announces public NatWest share sale