Chris Edwards

In his State of the Union address, President Biden is expected to discuss raising taxes on the rich. As he often does, Biden may claim that the rich pay lower tax rates than firefighters or school teachers or that the rich pay a tax rate of just 8 percent.

A Reuters story on the State of the Union address parrots the White House theme without any independent fact‐checking: “The average American worker paid about a 25% tax rate in 2022, the OECD reported. White House research found the wealthiest individuals paid about 8% from 2010 to 2018.”

White House “research”? The 8 percent is a concoction by Biden political appointees at odds with data from the US Treasury, Congressional Budget Office (CBO), Internal Revenue Service, and Joint Committee on Taxation. All these official sources find that tax rates on high earners are much higher than tax rates on lower‐ and middle‐income folks. Let’s look at the Treasury and CBO data.

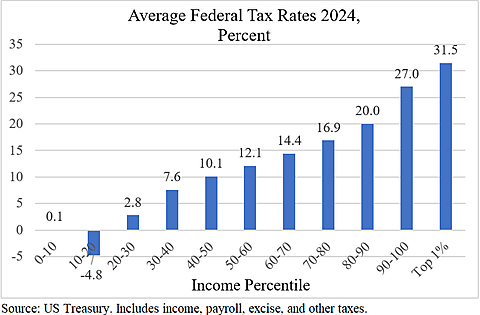

The first chart shows Treasury estimates for 2024 by income decile and the top 1 percent. The tax rates are all federal taxes (income, payroll, excise, and other) divided by family income. The top 1 percent will pay an average rate of 31.5 percent this year, compared with 10–12 percent in the middle and about 0 percent at the bottom. The rates near the bottom can be negative because of refundable tax credits.

The second chart shows Congressional Budget Office estimates for the low‑, middle‑, and high‐income quintiles and the top 1 percent. The tax rates are federal income, payroll, and excise taxes divided by household income.

The average tax rate on the top 1 percent has hovered around 30 percent for four decades.

Average tax rates on the low‐ and middle‐income quintiles have trended downward. Households in the low quintile pay no net federal taxes, while households in the middle quintile paid about 13 percent in recent years prior to 2020. Tax rates plunged in 2020 due to “recovery rebate credits” handed out that year, which were refundable tax credits.

In sum, Treasury and CBO data show that federal tax rates at the bottom average about 0 percent or less, tax rates in the middle average less than 15 percent, and rates at the top average around 30 percent. Average tax rates at the top are twice the tax rates in the middle.

False claims about tax rates on high earners are remarkably persistent given the easy availability of the official data. For further reading on tax rates by income level, see the following blog posts: “Biden Bulldozes Billionaires with New Tax,” “Tax Rates on the Rich,” “Tax Rates by Income Level,” and “Tax Rates by Income Level.”