The Senate has completed consideration of President Donald Trump’s $3.3 trillion, 940-page agenda bill, sending it back to the House of Representatives to sync up before hitting the commander in chief’s desk for his signature.

It first passed the House by just one vote in late May, and now it must advance through the chamber one more time before it can be signed into law.

That’s because the Senate made some key changes to the legislation, chiefly to pass the ‘Byrd Bath’ process in which its various measures are weighed for whether they adhere to the strict guidelines of the budget reconciliation process.

Republicans are using budget reconciliation to pass Trump’s agenda on taxes, the border, energy, defense and the national debt. It allows the party in power to pass fiscal legislation while sidelining the minority – in this case, Democrats – by lowering the Senate’s threshold for passage from 60 to 51.

Here are some of the key changes between the two versions:

Medicaid

Stricter work requirements have been the crown jewel for the GOP, being included in both versions. The bill would require able-bodied, childless adults between the ages of 18 and 64 to work at least 80 hours a month to maintain their benefits, or by participating in community service, going to school or engaging in a work program.

But there are more divisive changes, like tweaks to the Medicaid provider tax rate. The rate change would, year-by-year, lower the provider tax in Medicaid expansion states from 6 %to 3.5%. The plan was tweaked to comply with Senate rules, and now starts in fiscal year 2028.

The House bill, in comparison, would have frozen states at their current rates and placed a moratorium on new provider taxes.

It’s a sticking point for moderate House Republicans who could see their states be forced to foot more of the bill for Medicaid than they currently do, risking politically damaging cuts to the program.

The Senate bill also includes a $50 billion fund to help rural hospitals in a bid to ease the concerns of Republicans in their own chamber.

Debt ceiling

The Senate bill aims to raise the debt limit by $5 trillion, $1 trillion higher than the House bill called for.

The U.S. national debt is currently just over $36 trillion.

A failure to raise that limit – also called the debt ceiling – before the U.S. government runs out of cash to pay its obligations could result in a downgrade in the country’s credit rating and potential turmoil in financial markets.

Trump has made it a priority for congressional Republicans to deal with the debt ceiling and avoid a national credit default.

A bipartisan agreement struck in 2023 suspended the debt ceiling until January 2025.

Multiple projections show the U.S. is poised to run out of cash to pay its debts by sometime this summer.

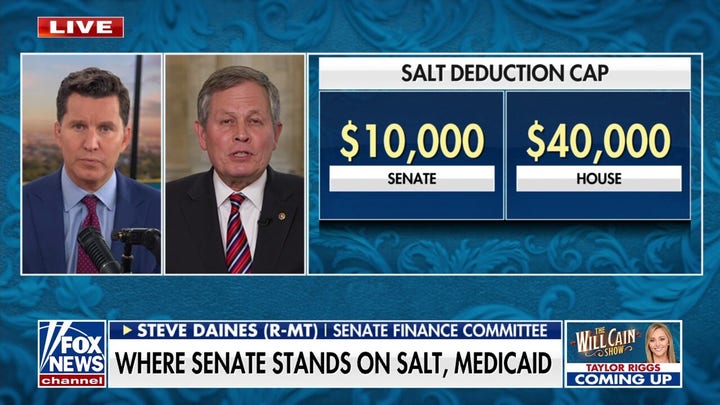

Taxes

The Senate version of the legislation provides more generous corporate tax benefits than the House version, while placing limits on Trump’s newer policies, eliminating taxes on tips and overtime pay.

Both bills sought to permanently extend the income tax brackets of Trump’s 2017 Tax Cuts and Jobs Act (TCJA).

The Senate bill makes permanent some corporate tax breaks that the House bill only temporarily expanded. It also makes permanent the standard deduction for personal income taxes, while the House bill only extended it through 2028.

The Senate bill would also allow people to deduct taxes on up to $25,000 of tipped wages. That deduction would begin to phase out for people making $150,000 per year or $300,000 as a married couple.

On the House side, the deduction is eliminated for both married and single filers making above $160,000. There is no cap of any kind on the amount that can be deducted, however.

Those same income differences are at play between the Senate and House versions of Trump’s ‘no tax on overtime pay’ promise. Whereas the Senate bill would allow people to deduct up to $12,500 in overtime pay, the House version did not include a stated limit.

Artificial Intelligence

The House version of the bill would have effectively blocked states from implementing their own AI regulations – a provision that was stripped out of the Senate bill even despite negotiations with critics to salvage the measure.

Sen. Masha Blackburn, R-Tenn., led the Senate GOP opposition to the measure, arguing it would prevent states from shielding populations who are vulnerable to the pitfalls of AI.

After talks with key senators fell through, Blackburn and Sen. Maria Cantwell, D-Wash., co-sponsored an amendment to remove that provision. It passed 99 to 1.

Outside of Washington, 17 Republican state governors wrote to Congress objecting to the AI moratorium.

‘This is a monumental win for Republican governors, President Trump’s one, big beautiful bill, and the American people,’ Arkansas Gov. Sarah Huckabee Sanders, one of the signatories, wrote on X after it was removed.