Adam N. Michel

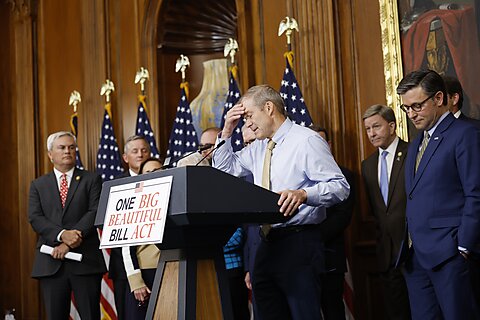

The One Big Beautiful Bill Act is now law, but the fight to restore fiscal discipline and support economic growth has only just begun. The next test will be how aggressively the administration follows through with regulatory implementation.

In a new Fox News op-ed, I detail how successful repeal of the Inflation Reduction Act’s green subsidies will depend on the Treasury’s next steps. President Trump’s July 7 executive order rightly directs the agency to clamp down on the biggest sources of waste: overly broad definitions of “beginning of construction,” subsidies to foreign-controlled firms, the abuse-prone 80/20 test for refurbished energy investments, and inflated appraisals of energy properties. If faithfully executed, changing these rules can finally shut off the spigot of taxpayer money to green subsidies and deliver the full fiscal savings promised in the bill.

But that’s just the beginning. There are many other tax provisions where regulatory details will determine the bill’s impact:

No tax on tips. Implementation will depend on defining “customarily tipped” occupations that are eligible for the tipped income exclusion and clarifying the treatment of additional service charges. Narrow rules could cap the revenue loss; broad interpretations will explode the cost.

Expensing for qualified production property. The Treasury must clarify what industries qualify as engaging in “substantial transformation” and how rules will govern mixed-use facilities. Broad inclusion will cement the economic benefits of this new provision.

Trump Accounts. Establish administrative rules for how accounts will be opened, accessed, and invested, including oversight for default investment options and account portability. Clarify whether the employer contribution cap (half of the $5,000 annual limit) is an annual or lifetime cap.

These are just a few of the hundreds of regulatory questions and transition rules the Treasury will need to address in implementing the One Big Beautiful Bill Act.

The Inflation Reduction Act shows how special interests can co-opt implementation, expanding access beyond congressional intent and exploding fiscal costs. Now, the Trump administration has the opportunity and the responsibility to do the opposite. By appropriately setting guardrails around eligibility and compliance, it can protect taxpayers, facilitate investment, and prevent another wave of expensive lobbyist-driven carve-outs.

The One Big Beautiful Bill’s success depends on how these rules are written and enforced. Congress did its part. Now, it’s up to the regulators to finish the job.